Your finances sorted with all-in-one accounting services

Free yourself from financial admin. Our dedicated experts and easy-to-use tools make managing your money easier.

What you get

Total visibility and control

over your finances

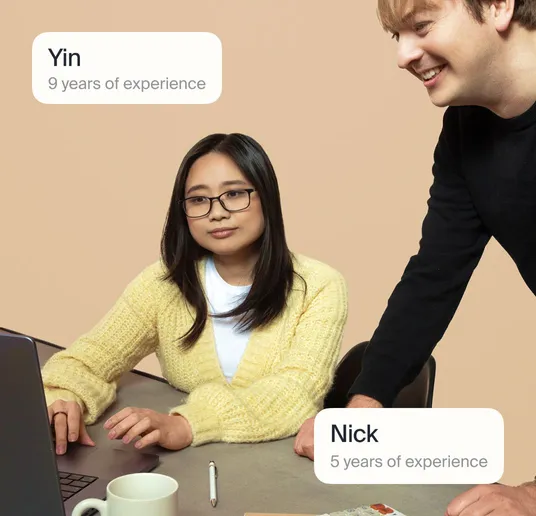

Dedicated accountant

Your dedicated accountant is on-call through live chat and responds within 24 hours.

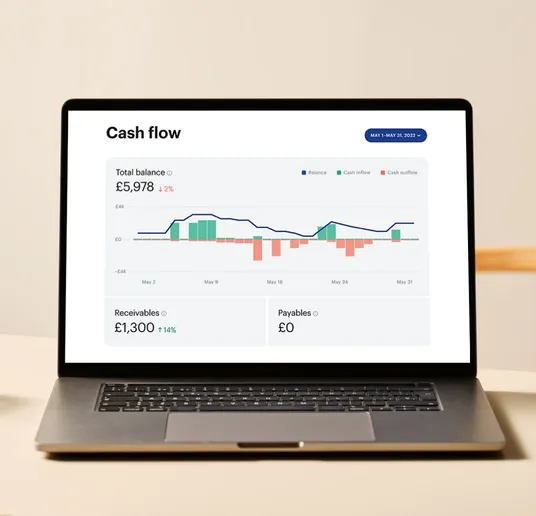

Easy-to-use software

Our financial tools give you control, automating invoicing, payments, and expenses with real-time cash flow insight.

Unlimited bookkeeping

Start your business the right way with incorporation, bank account and registered address.

Filing and compliance

Start your business the right way with incorporation, bank account and registered address.

Switching to RegisterTheCompany is simple

We chat directly with your previous accountant to get all the information required, and transfer your accounting software subscription and data all in one go. Making your transition to RegisterTheCompany effortless.

Who we help

For new founders and

seasoned entrepreneurs

Solo founders

You don’t have to do it alone. We help you register quickly and make sure you’re fully operational and compliant.

Small businesses

Start small and grow with confidence. We give you the experts and tools to track your cash flow, manage your finances, and pay the right tax.

Ecommerce

Forget generic accounting solutions. Our accountants know ecommerce and our software supports Amazon, Shopify, and eBay integrations.

Why RegisterTheCompany

Feel fully in control of your

business finances

Experts on your

side

Get a personal accountant for your business from day one. Our UK-based team helps founders get their taxes right from the start. Any questions? Get a response through live chat within 24 hours.

Get clear on

cash flowbr

With our real-time dashboard, your cash flow info is at your fingertips. Quickly see the money you have, what you owe, and how much you’re owed.

Pay the right tax

We help you stay on top of your finances. We keep track of deadlines and remind you about VAT and other compliance needs. Plus, our experts handle tax returns and filing, so you’re free to focus on your business.

Bookkeeping?

Pricing

Simple and fast company

formation

The cost to register a company with RegisterTheCompany depends on what you need. We can simply handle the

registration for you. Or we can handle your compliance and accounting needs too. Take a look at

your options below:

Operate

For business owners who want to ensure they tick all basic compliance boxes as they grow

£ 71 /m

£ 850 billed annually, per financial year + VAT

Financial software

- Create, send and chase invoices

- Capture bills and receipts easily

- Pay bills in one click

- Reimburse expenses

- Connect your banks

- Use multiple currencies

- Connect ecommerce marketplaces

Bookkeeping

- Unlimited bookkeeping

- Automatic reconciliations

Expert service

- Initial consultation with a tax expert

- In-app chat

- Tax advice on payroll and dividends

- Business review with accountant annually

Tax and filings

- Annual filings

- Self-assessment

Payroll

- PAYE registration

- 1st Director Payroll

Company admin

- Unlimited corporate changes

Historical work

- Catch-up bookkeepingCatch-up bookkeeping is mandatory if your current financial year has started before your sign-up date with RegisterTheCompany.£ 85/m

- Urgency filing£ 200

- Historical annual filing and bookkeeping

Grow

For businesses nearing VAT registration, seeking up-to-date analytics and consultations

£ 137 /m

£ 1,640 billed annually, per financial year + VAT

Financial software

- Create, send and chase invoices

- Capture bills and receipts easily

- Pay bills in one click

- Reimburse expenses

- Connect your banks

- Use multiple currencies

- Connect ecommerce marketplaces

Bookkeeping

- Unlimited bookkeeping

- Automatic reconciliations

Expert service

- Initial consultation with a tax expert

- In-app chat

- Tax advice on payroll and dividends

- Business review with accountant annually

- Video calls with an expert

- Business review with accountant monthly

- Ad-hoc tax advice

- Dedicated accountant

Tax and filings

- Annual filings

- Self-assessment

- VAT filing

- VAT registration

Payroll

- PAYE registration

- 1st Director Payroll

- Full payroll, 5 employees

Company admin

- Unlimited corporate changes

- Registered London office address

Historical work

- Catch-up bookkeepingCatch-up bookkeeping is mandatory if your current financial year has started before your sign-up date with RegisterTheCompany.£ 85/m

- Urgency filing£ 200

- Historical annual filing and bookkeeping

Scale

For entrepreneurs earning £350k+ annually, managing multiple roles and seeking to simplify financial tasks

£ 224 /m

£ 850 billed annually, per financial year + VAT

Financial software

- Create, send and chase invoices

- Capture bills and receipts easily

- Pay bills in one click

- Reimburse expenses

- Connect your banks

- Use multiple currencies

- Connect ecommerce marketplaces

Bookkeeping

- Unlimited bookkeeping

- Automatic reconciliations

Expert service

- Initial consultation with a tax expert

- In-app chat

- Tax advice on payroll and dividends

- Business review with accountant annually

Tax and filings

- Annual filings

- Self-assessment

Payroll

- PAYE registration

- 1st Director Payroll

Company admin

- Unlimited corporate changes

Historical work

- Catch-up bookkeepingCatch-up bookkeeping is mandatory if your current financial year has started before your sign-up date with RegisterTheCompany.£ 85/m

- Urgency filing£ 200

- Historical annual filing and bookkeeping

testimonials

What our clients think

about RegisterTheCompany

Facts & numbers

91 %

of customers recommend RegisterTheCompany services

CUSTMOR STORY

How Christos Fellas Saves 25 Hours a Month on Accounting

Facts & numbers

“RegisterTheCompany’s accountants are clear, responsive and proactive in giving advice and guidance when I need it.”

Company formation documents

What you get when you

register a company

Digital Certificate of Incorporation

This document outlines your limited company information and confirms your business can legally trade in the UK. It includes:

- Company’s registered name

- Company registration number

- Company registration location (England and Wales, Scotland or Northern Ireland)

- Incorporation date

Digital Statutory forms

These forms contain information about the limited company’s directors, secretaries and members.

Any form completed and sent to Companies House will be on the public record. This means the information, including any personal data, will be public unless the information is sensitive or restricted.

It’s important to keep these statutory forms up to date.

Articles of Association

These are written rules about running your company. Articles of Association are agreed by the shareholders or guarantors, directors, and the company secretary.

All limited companies must have Articles of Association after registering. You can write your own Articles of Association for your company, or use model ones provided by the UK government (these are default Articles of Association your company can use).

Bank account

Opening a business bank account allows your to handle financial transactions in your company’s name, with features tailored to business needs.

It is a legal requirement for limited companies and offers the advantage of keeping personal and company finances separate for tax purposes.

A business account is solely dedicated to business-related activities and operates independently from your personal finances.